The past year has not been good for mortgage lenders. A report from the Fannie Mae Federal Research Group shows that new home purchases were down by 16.5 percent in 2022. They project that 2023 will see a 13.3 percent decline from that.

The primary reason for the decline in home sales is interest rates. In 2022, the Federal Reserve raised interest rates six times to try to slow down rising inflation, fueled by a variety of factors, including the war between Russia and Ukraine and supply chain disruptions that are leftover from the COVID-19 pandemic.

That meant more homeowners stayed in their homes instead of looking for new ones, having already locked in lower interest rates. It also meant consumers with debt had less money to put toward a house, as the rate increase impacted everything from credit cards to car payments.

At the same time, the supply chain disruptions meant home builders struggled to source building materials. As a result, there was a decrease in the number of new homes constructed in 2022.

So, what should mortgage lenders expect from 2023, and how can they ensure this year is better than the last?

This article will look at what’s in store for 2023 to help mortgage lenders determine the best strategies to implement so they can have a better year.

5 Trends to Expect from the Mortgage Industry in 2023

While it is impossible to predict the future with 100 percent accuracy, it is possible to make predictions based on the current market. With that in mind, here are some overall trends mortgage lenders can expect to see in the coming year and advice for how to capitalize on them.

1. Continued increases in mortgage rates with a mid-year peak

Interest rates will continue to climb for the year’s first half, with a peak expected around mid-2023. Because of this, mortgage lenders should expect to see more of what they saw in 2022 as fewer homes get sold. However, at a certain point, people who need to move for various reasons (e.g., downsizing, moving for work, etc.) will need to buy a house, regardless of the interest rate.

Advice for mortgage lenders: The first few quarters of 2023 may look eerily similar to 2022, with fewer people applying for mortgages. That makes this a great time to invest in technological upgrades that will be ready when the market starts to get back to normal.

2. Home sales will pick up later in the year

After interest rates peak in the middle of 2023, they will start declining slowly, opening the market to more home buyers. This should lead to an increase in home sales in the last two quarters of the year.

Advice for mortgage lenders: Mortgage lenders will need to be prepared for a rapid acceleration in loan applications. Having technological tools implemented and ready to go will help them stay on top of loan applications, getting homebuyers approved quickly so they can close their mortgages and get into their new homes as quickly as possible.

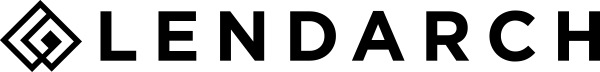

3. More lenders will implement automation and other digital tools to streamline the mortgage process

The increase in third-party tools available to help mortgage lenders with everything from automating emails to approving loan applications is helping many mortgage lenders close more deals without sacrificing accuracy or personalization. However, any lender that isn’t using these tools will find themselves behind the curve in the later months of 2023 as the market picks up and loan applications begin to flood lenders.

Advice for mortgage lenders: Carefully review the lending process in these early months of 2023. Identify bottlenecks in the lending process to determine the best areas to invest in digital tools. For example, there are digital tools available to help with email response times, loan advertisements, and loan approval automation.

4. Non-bank lenders continue to grow

The rise in non-bank lenders will continue in 2023. These companies rely heavily on technology to streamline the mortgage application and approval process, making it simple for consumers to apply for and sign on a loan without ever entering a bank. This is a global mortgage trend that will continue growing in the American market.

Advice for mortgage lenders: The only way to compete with this growing market is to undergo a digital upgrade. Today’s consumers expect an Amazon-like experience with every interaction, from shopping for clothes online to buying a home. As a result, they care about convenience over everything else and won’t hesitate to find another lender who can speed up the process for them if necessary.

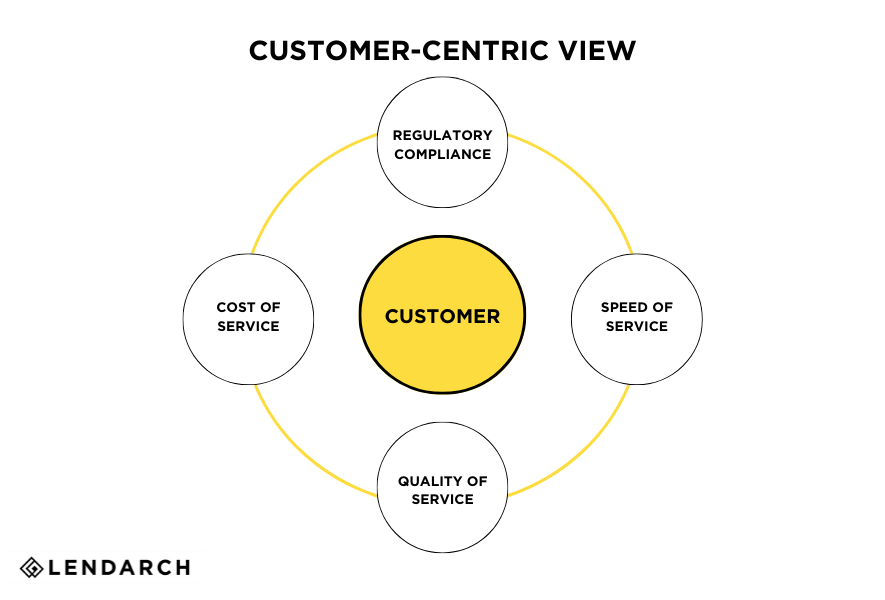

5. Customer service will remain critical

Finally, customer service will remain an integral part of the mortgage process, even in a digital world. However, customer service today is different from what it was a few decades ago. For example, today’s consumers don’t necessarily want to visit a bank or financial institution to discuss their mortgage options. Instead, they often prefer to get an estimate and apply for a loan online. So, finding ways to improve the customer experience will be crucial for mortgage lenders in 2023.

Advice for mortgage lenders: When thinking about customer service, think about customer experience. What is the process like on the consumer end, and what can be done to make it more accessible? For example, how can a mortgage lender reduce the time it takes to get approved for a loan or to finalize signatures? Answering these questions will require lenders to analyze their current processes to identify areas of improvement.

Find the Right Digital Mortgage Tools to Keep Up with Trends in 2023 with LendArch

While the first few months of 2023 may feel the same as 2022, there is hope that things will get better in the second half of the year. Mortgage lenders need to be ready for a deluge of loan applications as more homes come on the market and interest rates return start to lower.

The experts at LendArch can help mortgage lenders determine the best tech stack to implement to streamline their processes. Get in touch with us today to get started.

As Chief Executive Officer, Tammy Richards brings over 35 years experience in Mortgage Banking, EClose/EMortgage, Robotics/AI/OCR/ICR implementation and more. She has been an executive and has led Nationally at Bank of America, Caliber Home Loans and most recently served as Chief Operating Officer for Loan Depot. She is passionate about and is an expert in the mortgage industry's ongoing tech transformation.