When is the right time for a mortgage lending company to create digital transformation?

For many lenders, the answer is “soon” or “not right now, but maybe later.”

Every lender thinks they can wait to optimize their mortgage technology stack and operations environment. They believe that what they are doing is working and always postpone their decisions on upgrading technology.

Unfortunately, that way of thinking is detrimental to mortgage lending companies. Instead of putting it off until later, lenders need to recognize that the time to update their mortgage technology stack is now.

Challenges with the Traditional Mortgage Assembly Line Model

Many lenders have taken a lesson from manufacturing and applied an assembly line approach to the mortgage process.

In this analogy, the mortgage process is the conveyor belt, with each step – from application to final signatures and disbursement– a tool that needs to be added to the final product. Everyone in the mortgage process plays their specific role, and bottlenecks hold up the line.

Human errors and technological and operational inefficiencies often cause those bottlenecks.

They can be fixed with the right technological tools that speed up the assembly line and make the process smoother for everyone involved.

Why It’s Time to Update The Mortgage Technology Stack

There is no need to make a LOS change or large Capex commitments. The technology options today are agile, lite, and economical.

Here are some benefits to upgrading the mortgage lending technology stack and taking part in the digital transformation that is impacting companies across industries.

Reason 1: Today’s mortgage customers expect a digital experience

The digital transformation is affecting every industry, from finance to healthcare, manufacturing, retail, hospitality, education, and beyond.

That means today’s average consumers have come to expect an Amazon-like buying experience every time they interact with a company. A mortgage lender is no exception.

Buying, selling, and refinancing a house are stressful enough without adding in all the extra time it takes to stay on top of the mortgage lending process. Today’s homebuyers and sellers don’t want to waste time meeting in person or driving all over town to do something that can easily be managed online.

Bottom line: If a lender is using outdated, archaic processes, their customers will seek mortgage assistance from another lender that has figured out how to use technology to save time and reduce the cost of service.

Reason 2: Personnel resources are likely wasting their time on tasks that could be automated

A lending company may have a team of mortgage-savvy professionals currently managing every aspect of the lending process. But there’s a very good chance their talent is being wasted on tasks that could easily be automated with the right technology.

Bringing in new technologies to automate processes saves everyone time. Letting technology automate menial tasks opens up opportunities for the human workforce to work on more complex tasks and projects that require a mortgage lender’s careful attention.

Reason 3: Technology allows lenders to serve more people

What can a lending company do with all that time they save between holding in-person meetings and managing menial tasks? Help more people.

The mortgage industry is expected to generate $2.5 trillion yearly for at least the next three years. That represents a 40 percent higher growth rate than all of the years 2010 through 2019.

Mortgage lenders who want to be part of that growth will need to find ways to scale quickly, and undergoing a digital transformation is the best way to get there.

What to Consider in a Mortgage Digital Transformation

With a clearer idea of why lending companies should update their technology stack, it’s time to learn more about how to partake in a digital transformation.

What Does Mortgage Digitization Entail?

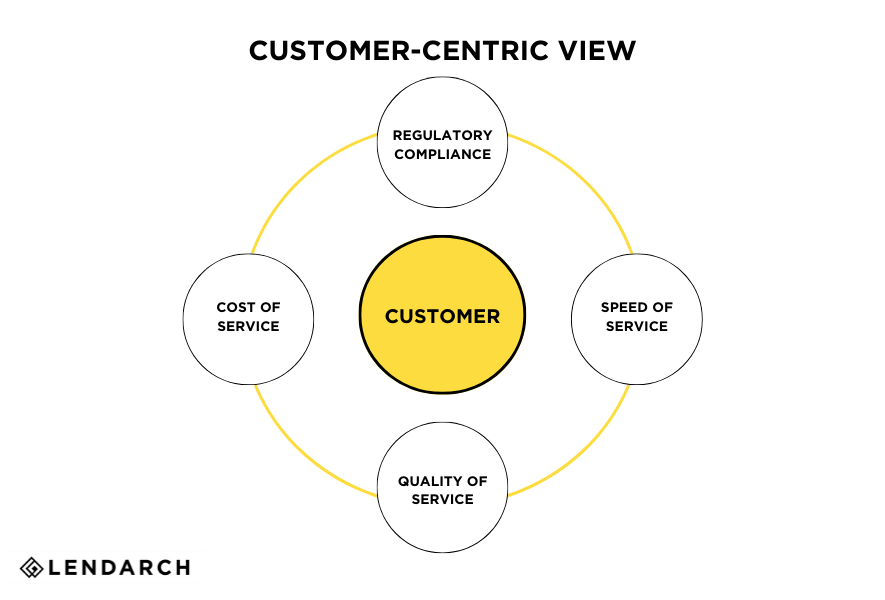

Digitizing the mortgage process is all about making things easier for the customer. Everything from the application process to compliance, risk assessment, and cost containment needs to be digitized to make the mortgage process more accessible and less cumbersome for clients.

Precisely what technology stack a lender needs will depend on a variety of factors. Lenders who are unsure where to start don’t need to panic – LendArch is here to help mortgage lending companies determine which tech tools will be the most beneficial as they work toward digitizing the mortgage process.

Will Technology Enable Straight Through Processing (STP)?

When implemented correctly, digital technology can enable a straight-through mortgage lending process. This means that every step of the mortgage process is automated, from application to disbursement. For example, KEB Hana Bank, the third largest bank in South Korea, pioneered digitization of mortgage processing with its ‘One Click’ Mortgage, from e-application to e-closing.

Of course, not every mortgage application will qualify for STP. However, by automating many tasks, mortgage lenders can reserve their resources to focus their efforts on applications requiring intervention by effort.

How Complicated is it to Change A Tech Stack?

The answer to this question will depend on several factors, such as the firm’s existing technology, the new technology it wants to implement, and the current team’s experience.

Many businesses across industries get stuck at this stage because their culture isn’t ready to handle a digital transformation.

It’s important to remember that complicated doesn’t have to mean difficult. Working with a partner like LendArch, enables even the most complex changes to be done in a way that allows clients and team members to transition smoothly to a new digital format.

Ready for A Digital Transformation? Let’s Talk!

Lending companies need to accept that now is the time for a digital transformation, whether they feel ready or not.

The good news is that there’s no need for mortgage lenders to go through it alone!

LendArch is here to help mortgage lending companies determine the best technology stack for their business. We have the technology and know-how to help firms of all sizes digitize mortgages for their customers.

Our experts can help determine the tools needed to move any mortgage lending business forward. Contact us today to get started!

As Chief Executive Officer, Tammy Richards brings over 35 years experience in Mortgage Banking, EClose/EMortgage, Robotics/AI/OCR/ICR implementation and more. She has been an executive and has led Nationally at Bank of America, Caliber Home Loans and most recently served as Chief Operating Officer for Loan Depot. She is passionate about and is an expert in the mortgage industry's ongoing tech transformation.