Nearly all mortgage firms (92%) have doubled the pace of their digital transformation over the last few years due to the pandemic. The need to do business online has dramatically sped up the need for companies to transition to digital forms of communication and interaction.

And yet, the mortgage industry is still lagging behind other financial services when it comes to the amount of paper required to complete the process.

Being bogged down by antiquated lending processes puts mortgage companies at risk of being overrun by competitors who have adopted new digital technologies to speed up the approval process for home buyers.

The issue is not so much that older technology choices slow down the process for mortgage companies themselves. Instead, the problem is that home buyers don’t want to sit and wait longer than necessary to find out if they have been approved for a mortgage.

Thanks to the advancement of digital transformation across sectors, consumers generally expect streamlined, straightforward processes with every transaction they make, including applying for and getting a mortgage.

So, what can mortgage companies do to speed up the lending and approval process without overlooking critical steps in the mortgage process?

The answer is to embrace mortgage automation.

What is Mortgage Automation?

In general, automation refers to a process that reinvents workflows to eliminate redundancies and reduce the amount of time humans spend on everyday and repetitive tasks.

So, mortgage automation is a process that automates specific tasks so computers rather than people can perform them. This happens through artificial intelligence (AI) and machine learning (ML) technologies.

Monolithic applications are not prepared to keep up with evolving technology, like AI and ML. That’s why many banks and financial institutions are migrating their monoliths to microservices-based mortgage automation technology. This move decouples mortgage lending services into a collection of independent, function-specific services that can be merged as needed.

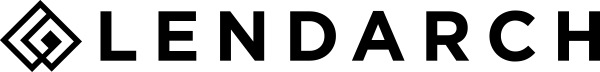

How Can Mortgage Automation Improve Loan Processing?

Mortgage automation aims to speed up the lending process for lenders and borrowers without compromising quality or integrity.

The great news is that mortgage automation can improve the lending process’s quality by reducing or eliminating calculating errors and speeding up the time it takes for home buyers to get approved for a loan.

Here are a few other ways mortgage automation can improve loan processing.

1. Let computers take on repetitive tasks to free up your human resources

There are ways to use machine learning to automate every step of the mortgage lending process, from application until close. Some of the tasks that AI and ML technology can take over from humans during mortgage automation include:

- Data entry

- Document collection

- Credit ordering and analysis

- Income verification

- Document data validation

- Tax transcript review

- Credit risk modeling

- Reviewing documents for fraud

- Appraisal review

In addition to speeding up the process for applicants and lenders, mortgage automation creates opportunities to improve the human-centered processes involved in reviewing applications, verifying data, and underwriting the loan.

2. Simplify the loan application process

Consumers expect a streamlined application process for everything they buy, including a home. So, having a seamless application process eliminates unnecessary time-consuming steps that might cause a borrower to walk away. By streamlining the application process using mortgage automation that utilizes national language processing (NLP), applicants can spend less time applying for a loan. They can also have faster access to human resources whenever they need extra support completing an application or getting answers to their questions about the home buying and mortgage lending process.

3. Build stronger customer relationships

When machines are handling many of the time-consuming tasks involved in the lending process, lenders are able to focus on building relationships with new and existing customers. A better mortgage lending experience makes customers more likely to return to a lender.

4. Have more flexibility with microservices

Monolithic services used to be the standard for financial institutions. They were designed to power all the functions of a business. However, monolithic options do not scale or adapt easily as businesses change. Microservice mortgage technology is significantly more flexible and customizable than monoliths. Mortgage lending companies that use microservices can be more agile and quicker to adapt to changes. They can also scale easier while reducing infrastructure and maintenance costs.

Things to Consider with Mortgage Automation

There are many digital tools available to help with mortgage automation. As you start to think about which ones will be the most valuable to your lending company, here are a few things to consider.

1.Look for a good user experience

Great technology can only go so far in creating a better lending experience. If the technology is difficult to access or understand, nobody will benefit.

So, in addition to speeding up the lending process, mortgage automation should provide an overall better user experience. Look for mortgage automation software with an intuitive design that walks lending applicants through the process efficiently and smoothly.

Along with helping consumers, mortgage automation software should be easy for lending teams to access and use without needing to rely on support to answer all their questions.

2. Machine learning

Not every mortgage automation software advertised is genuinely built on machine learning technology. Look for machine learning software to identify and analyze the data it collects.

This will make it easier for lending teams to gather and analyze historical data. Then, they can follow AI-powered recommendations to make lending decisions that benefit the mortgage company and the consumer.

3. Central hub

A decentralized system creates chaos and confusion for consumers and lenders. Look for mortgage automation software with a centralized hub where workflows exist in a single platform.

Keeping every step of the mortgage application and lending process in one place makes it less likely that information will be lost or duplicated and more likely that lenders and borrowers will be able to work together for a more streamlined lending process from start to finish.

4. Learn from failures and successes

Because automation is not new, it is possible to look at and learn from previous successes and failures. An estimated 50 percent of process automation applications fail during their initial launch.

Then there are success stories, which come from all over the world. For example, KEB Hana Bank in South Korea introduced a “one-click mortgage” feature that allowed mortgage applicants to quickly apply for a mortgage online. The bank saw $2.4 billion in sales after just 10 months of implementation.

Have More Questions about Mortgage Automation? Talk to LendArch

LendArch believes the future of mortgage lending is digital and that mortgage automation will become the norm, not the exception. Mortgage automation improves the lending experience for everyone. In addition to speeding up the process, it helps lending companies build more robust and longer-lasting relationships with their customers.

To learn more about mortgage automation, contact the LendArch experts. We are available to answer questions about mortgage automation and help mortgage lending companies discover the best solutions for their business.

As Chief Executive Officer, Tammy Richards brings over 35 years experience in Mortgage Banking, EClose/EMortgage, Robotics/AI/OCR/ICR implementation and more. She has been an executive and has led Nationally at Bank of America, Caliber Home Loans and most recently served as Chief Operating Officer for Loan Depot. She is passionate about and is an expert in the mortgage industry's ongoing tech transformation.